Credit Repair Myths Debunked: Dividing Fact from Fiction

Credit Repair Myths Debunked: Dividing Fact from Fiction

Blog Article

Just How Credit History Repair Works to Remove Mistakes and Increase Your Credit Reliability

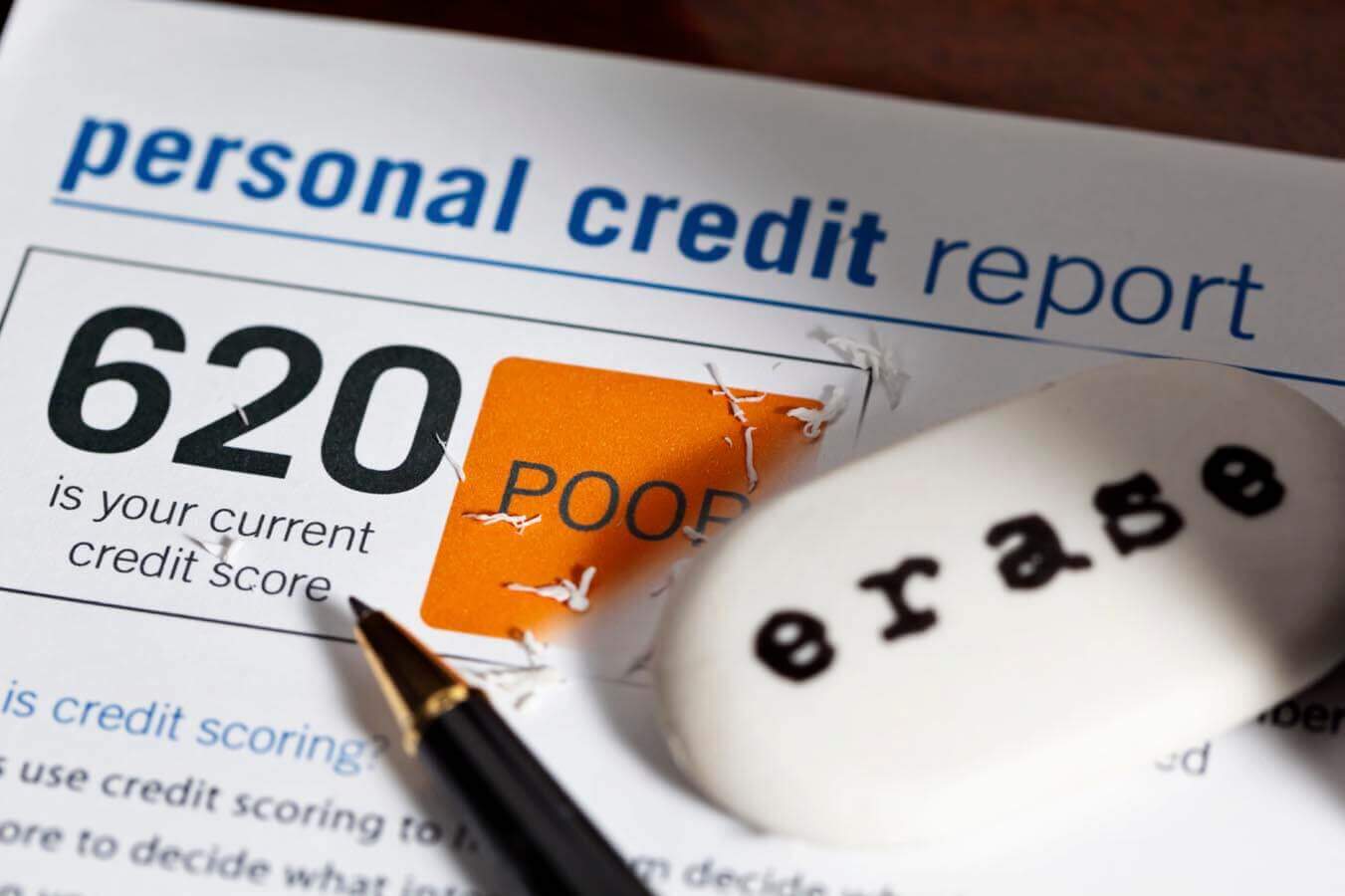

Credit report repair work is a critical process for individuals looking for to boost their credit reliability by dealing with mistakes that might compromise their monetary standing. By diligently analyzing credit reports for typical mistakes-- such as wrong individual information or misreported repayment histories-- individuals can launch an organized disagreement procedure with credit bureaus. This not only corrects false info however can also bring about substantial enhancements in credit rating scores. The implications of these modifications can be profound, influencing everything from car loan approvals to interest prices. Understanding the subtleties of this process is essential for attaining ideal outcomes.

Understanding Credit Score Reports

Debt reports work as an economic snapshot of a person's credit report, outlining their loaning and settlement behavior. These reports are compiled by credit rating bureaus and consist of important information such as debt accounts, arrearages, repayment background, and public records like bankruptcies or liens. Monetary organizations use this data to examine a person's credit reliability when looking for car loans, credit cards, or mortgages.

A debt record normally consists of personal information, consisting of the person's name, address, and Social Security number, along with a list of credit history accounts, their condition, and any late settlements. The record also details credit scores queries-- circumstances where loan providers have accessed the record for examination functions. Each of these parts plays a crucial function in determining a credit rating rating, which is a numerical representation of credit reliability.

Understanding credit rating records is necessary for consumers intending to manage their financial wellness successfully. By routinely evaluating their records, individuals can ensure that their credit report history properly shows their financial actions, therefore positioning themselves favorably in future borrowing endeavors. Awareness of the contents of one's credit score report is the primary step toward effective debt repair work and overall monetary well-being.

Usual Credit Score Report Errors

Errors within credit records can dramatically influence a person's credit rating rating and total economic health and wellness. Common credit history record errors include inaccurate personal info, such as incorrect addresses or misspelled names. These disparities can lead to confusion and might influence the analysis of credit reliability.

An additional constant mistake entails accounts that do not come from the individual, usually arising from identification theft or unreliable information access by financial institutions. Combined documents, where someone's credit rating information is combined with an additional's, can likewise happen, particularly with people that share similar names.

Additionally, late payments might be erroneously reported due to processing misconceptions or errors pertaining to payment days. Accounts that have been worked out or repaid may still appear as outstanding, more complicating a person's credit history profile.

Moreover, mistakes concerning credit line and account equilibriums can misstate a consumer's credit rating application ratio, a critical consider credit history. Identifying these mistakes is important, as they can lead to greater rate of interest, car loan rejections, and enhanced problem in getting credit score. On a regular basis evaluating one's credit report is a positive action to identify and correct these typical errors, hence safeguarding monetary health and wellness.

The Credit Report Repair Service Process

Browsing the debt fixing procedure can be a difficult task for several people seeking to boost their monetary standing. The trip starts with obtaining a thorough debt report from all three significant credit report bureaus: Equifax, Experian, and TransUnion. Credit Repair. This enables consumers to determine and recognize the elements influencing their credit report

Once the credit score report is reviewed, people ought to categorize the information right into accurate, inaccurate, and unverifiable things. Accurate info should be kept, while errors can be objected to. It is important to gather sustaining documents to substantiate any type of cases of error.

Next, individuals can choose to either manage the procedure independently or enlist the assistance of specialist credit report repair services. Credit Repair. Experts usually have the proficiency and resources to browse the intricacies of credit reporting laws and can simplify the process

Throughout the imp source debt repair service procedure, maintaining timely repayments on existing accounts is critical. This demonstrates responsible financial habits and can favorably influence credit report. Ultimately, the credit report repair process is a methodical technique to identifying concerns, disputing mistakes, and cultivating much healthier financial practices, resulting in improved credit reliability with time.

Disputing Inaccuracies Successfully

An efficient dispute procedure is critical for those seeking to correct inaccuracies on their credit rating records. The initial step involves obtaining a duplicate of your credit rating report from the major credit bureaus-- Equifax, Experian, and TransUnion. Testimonial the report meticulously for any kind of inconsistencies, such as incorrect account details, outdated info, or fraudulent entrances.

Once mistakes are identified, it is necessary to gather sustaining documents that corroborates your insurance claims. This might include settlement receipts, financial institution declarations, or any type of pertinent correspondence. Next, launch the dispute procedure by contacting the credit scores bureau that issued the record. This can usually be done online, via mail, or over the phone. When submitting your disagreement, offer a clear description of the error, together with the sustaining proof.

Benefits of Debt Repair

A multitude of benefits accompanies the procedure of credit rating repair service, dramatically influencing both economic security and general high quality of life. Among the main advantages is the potential for improved credit history. As errors and errors are fixed, people can experience a remarkable increase in their credit reliability, which directly influences funding approval prices and passion terms.

Furthermore, credit fixing can improve access to desirable funding options. People with higher credit report are more probable to certify for lower rates of interest on mortgages, vehicle financings, and personal lendings, inevitably resulting in significant savings with time. This improved monetary flexibility can assist in significant life decisions, such as acquiring a home or investing in education.

With a clearer browse around this web-site understanding of their credit history circumstance, individuals can make enlightened options concerning debt use and administration. Credit report repair work often entails education on financial proficiency, equipping individuals to take on much better spending routines and maintain their credit health and wellness long-term.

Verdict

In conclusion, credit history repair work serves as an important mechanism for enhancing credit reliability by addressing errors within credit report reports. By understanding the subtleties of credit report records and employing efficient conflict methods, individuals can achieve better monetary health and security.

By diligently checking out credit rating records for typical errors-- such as wrong personal details or misreported settlement histories-- people can start a structured disagreement process with credit rating bureaus.Credit scores records serve as an economic picture of a person's debt background, detailing their loaning and payment behavior. Recognition of the components see this website of one's credit score report is the initial step toward successful credit history repair work and total financial wellness.

Mistakes within credit report records can considerably influence a person's credit scores rating and overall monetary wellness.Additionally, errors relating to credit scores limits and account balances can misstate a customer's credit scores use proportion, a crucial aspect in credit scoring.

Report this page